**Remember, taxes are complicated. This blog isn’t meant to dive into the nitty gritty details. Each stay will differ when it comes to charges and tax rates. This is meant to help you understand where to start, what to expect, and help guide the conversation you’ll have with your Compass Crew member. Our team is here to walk you through every single thing you need to know, so don’t worry!

DIFFERENT STATES. DIFFERENT RULES.

CALLING ALL MASSACHUSETT-ERS

For all our Boston-ers out there, Massachusetts is known to be the most difficult state when it comes to taxes…or at least for us it is. Not only should you be aware of statewide taxes, but that local city taxes come into play, as well. Let’s break this down:

That is Massachusetts. Welcome! Now onward to easier things…

CONNECTICUTIANS, RALLY UP

*based on original lease terms

TO THE EMPIRE STATE CITY

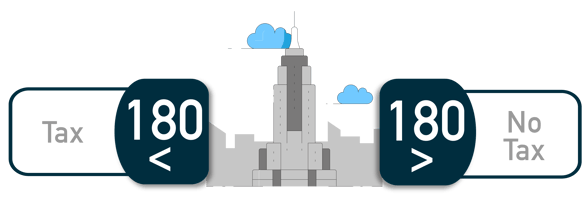

This is applied to New York City, NOT New York State as a whole.

Stays under 180 days: Tax.

Stays over 180 days: No tax.

NYC taxes by city and room. Our Compass Crew will go over what that means throughout your reservation process. If you’re looking for answers now, email salesteam@compasscorp.com (accounting?) and we’ll give you a more in-depth breakdown.

And that, my friends, is taxation in a nutshell for the 3 major states we operate in. As a summary, remember that taxes vary not only state to state but city to city, as well. Ask a Compass Crew member what this looks like in the city you’re getting ready to book. Click here to go through our full rate guide!

HOW CAN STAYING LONGER IN A FURNISHED APARTMENT SAVE YOU MONEY?! ⭐💰⭐

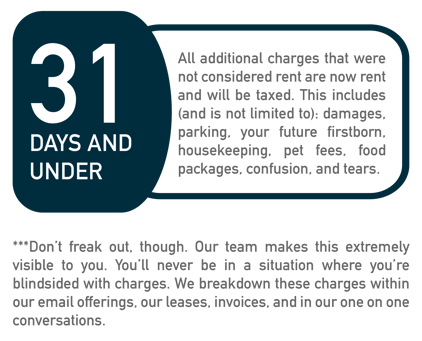

During your reservation process, we’ll explain different options that are available to you based on your request. For example, if you say you want to stay in Massachusetts for 29 days, we’ll let you know of MA’s tax regulations that are also listed above. We’ll explain that any stay over 32 days in MA isn’t taxed at all, whereas any stay 31 days and under, will not only be taxed, but all those additional charges that were not considered “rent” before, would now be considered rent and you’ll be taxed for those, as well.

More often than not, you’ll be saying, “…alright then, staying 32 days doesnt sound too shabby”!

When it comes to extending a pre-existing stay in hopes of saving, companies can only save by extending their stays in NYC or Boston in very certain circumstances, which we’ll go over with you! Why should you stay in a furnished apartment instead of a hotel? See our complete cost comparison here.

THINGS HAVE CHANGED

Compass now has a minimum of 30 day stays (10 day minimum for proven business stays). Why? Well, it’s not us making the call, it’s the regulations that we have to follow that are changing. Because we have to do this, we wanted to include it within this blog to let you know that we truly believe in transparency. We know taxes and regulations are confusing, they confuse us sometimes! Just know, we always have your best interest in mind.

YOU’RE NOT ALONE!

Our team is always trained on the newest regulations and tax rates. We’ll give you a complete break down of costs, expectations, and regulations that you fall within. We’re constantly working with the states to make sure we’re complying to all regulations.

If you have any more questions or want us to dive into a specific topic further, send us an email or give our team a call! We want to make sure we’re being as transparent and educational as we possibly can within this ever changing landscape.

Remember: City rates can change at any time and at any amount without warning. Compass makes sure to keep you updated, informed, and on the same page.